What the recent inflation numbers, really mean.

The Bank of Canada measures inflation in different ways. The most accurate measurement, in my view, is the Consumer Price Index (CPI). This is a measure of a fixed basket of goods and services that is purchased regularly by the consumer. This measure includes volatile items like fuel, nuts, fruits, heating fuels, and mortgage interests.

Another measure is called “Core Inflation Measure” this measure excludes volatile items.

According to the BOC inflation calculator, the rate of inflation from 2019 to 2023 is 16.42%.

CPI stayed the same at 3.1% for the month of November. The target rate is 2.0% to 3.0%.

CORE dropped by .1% to 2.7% for the month of November. The target rate is 2.0% to 3.0%.

The CORE inflation rate is moderating, slowly, but the CPI is stubbornly high.

Over the last few years, we have all felt the affects of “inflation.” The costs of goods and services will not become less expensive, in the near term, even if the inflation targets (CPI) is reached. It is likely that the rate of inflation will meet the target rate in the coming months.

What does this mean? It means that achieving the target rate, will not change the current prices of goods and services, they will broadly remain the same and will increase over time at the rate of inflation.

Observing the media, I wonder if they understand that achieving the target rate, doesn’t change much for the average consumer, it only means that prices will stay the same and increase at a lesser rate. The media, seems to proclaim that once target rate is reached the crisis is over. I don’t think so. Your costs will remain the same for almost everything.

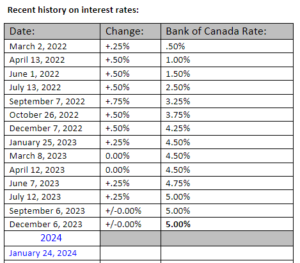

What am I saying? I am saying, yes, although we are moving in the right direction, consumer prices will stay the same and increase more slowly. Be careful with your funds, and don’t expect prices to be much less in the near term. Rates will likely stay level for the next 6-9 months and we may see slow and slight rate decreases in 2024 and 2025. Anyone with an upcoming mortgage renewal should seek advice from an independent expert, such as myself to try to maximize the upcoming changes.

Next rate announcement is January 24, 2024. If you would like to chat more about current and future interest rates, please (contact me).

Getting in touch is easy (contact me).

If you would like more information about Mortgages or one of Sam’s Shorts, you are always welcome to contact us.